Gold Buying Tips

Gold Buying Tips: A Complete Guide for Beginners and Investors

Introduction

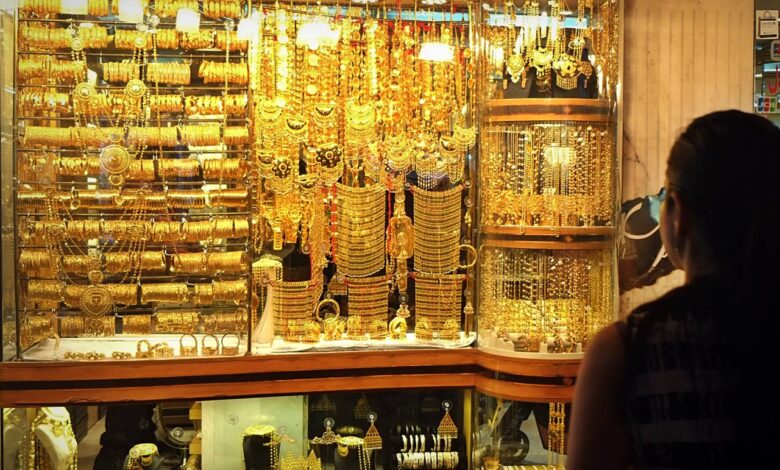

Are you planning to buy gold for the first time? Purchasing gold can be a smart investment, a way to preserve wealth, or simply a special gift for a loved one. However, before you dive into buying gold, it’s essential to understand some important “Gold Buying Tips” to ensure you’re making the best decision. This guide will provide you with easy-to-understand, informative advice on buying gold, whether for personal use or as a part of your investment portfolio.

What You Should Know Before Buying Gold

Gold has been a valuable commodity for centuries, admired not only for its beauty but also for its ability to maintain value during times of economic uncertainty. Here are some fundamental things you should know before buying gold:

- Types of Gold Investments When buying gold, it’s essential to know that there are different ways to invest. Here are the common forms:

- Physical Gold: Includes coins, bars, and jewelry. This type of investment allows you to hold gold in its physical form, which many people prefer for security and tangibility.

- Gold ETFs (Exchange-Traded Funds): These are investment funds that represent gold ownership but don’t require you to store physical gold.

- Gold Mining Stocks: These are investments in companies that mine and produce gold. It’s riskier compared to holding physical gold but can yield higher returns if the company performs well.

Gold Buying Tips: How to Get the Best Value

To make the most out of your gold purchase, consider these practical “Gold Buying Tips”:

1. Understand the Gold Purity Levels

Gold purity is often measured in karats, with 24 karat being pure gold. However, most jewelry is made from 22K, 18K, or 14K gold, mixed with other metals for added durability. The higher the karat, the purer the gold. Before purchasing, decide what level of purity is right for your needs.

2. Buy from Reputable Dealers

Whether you’re buying physical gold or investing in ETFs, purchasing from reputable dealers is crucial. Look for established jewelers, online platforms, or banks that have a good track record. Ensure they provide authentication certificates with every gold purchase.

3. Pay Attention to Gold Prices

Gold prices fluctuate daily based on the international market. Monitor gold prices for a while before buying, and try to purchase during times when prices dip. This will help you get better value for your investment.

4. Know the Making Charges for Jewelry

When buying gold jewelry, remember that the price isn’t just about the weight of the gold. Jewelry usually comes with “making charges,” which can significantly add to the cost. Always inquire about these additional fees and consider buying from vendors who have transparent pricing policies.

5. Verify Hallmarking

Hallmarking is a certification of purity that ensures the gold is genuine. In many countries, hallmarked gold is the standard for quality assurance. Always check for hallmark stamps before buying gold. Next article Here Go Sea Salt Spray

Frequently Asked Questions (FAQ) About Gold Buying Tips

1. What is the best type of gold to buy for investment purposes?

The best type of gold for investment often depends on your preferences and goals. If you prefer a tangible asset, consider buying gold bars or coins. For ease of buying and selling without storage issues, Gold ETFs might be a better choice. Gold mining stocks are more volatile but can offer higher returns if the market performs well.

2. How do I determine the purity of gold?

Gold purity is measured in karats, with 24K being the purest form. Lower karat ratings, such as 22K, 18K, or 14K, indicate that other metals have been mixed with gold to improve its durability. Look for hallmarking symbols to verify the purity of the gold you are buying.

3. Why do gold jewelry prices include making charges?

Making charges are the cost of designing and crafting the gold jewelry. These charges vary from one jeweler to another and can add significantly to the total cost of gold jewelry. It’s important to inquire about making charges before making a purchase.

4. What factors affect the price of gold?

Gold prices are influenced by several factors, including supply and demand, global economic stability, currency values, and geopolitical events. Gold often increases in value during times of economic uncertainty as it is considered a “safe-haven” asset.

5. Is buying gold a good way to protect against inflation?

Yes, buying gold is considered a good hedge against inflation. Gold typically maintains or increases its value when the purchasing power of currency declines, making it an effective way to protect your wealth in times of inflation.

6. Where is the safest place to buy gold?

The safest places to buy gold include reputable jewelers, authorized online gold-selling platforms, banks, or government mints. Always ensure that the seller is trustworthy and provides certificates of authenticity for the gold you purchase.

7. Should I invest in gold ETFs or physical gold?

Investing in gold ETFs provides liquidity and ease of buying and selling without the hassle of storage. Physical gold, however, offers a tangible asset that can be held securely. Choose based on your investment strategy, preference for physical ownership, and convenience.

8. How can I store gold safely?

Storing gold safely can be done by keeping it in a bank’s safety deposit box or in a secure home safe. If you are investing heavily in physical gold, professional storage services provided by specialized firms might also be a good option.

9. What are the risks of buying gold?

While gold is often seen as a safe investment, it comes with risks such as price volatility, storage costs for physical gold, and lower yields compared to other assets. It is important to diversify your investments rather than relying solely on gold.

10. How can I avoid scams when buying gold?

To avoid scams, buy only from reputable sellers, verify the hallmarking on the gold, and always request a bill or certificate of authenticity. Avoid deals that sound “too good to be true” and do your research before purchasing from unknown sources.